HMRC Corporation Tax Services in Peterborough

Corporation Tax Returns Peterborough

GGM Accountancy Ltd provide an essential service for companies dealing with corporation tax within your business operation. All reliefs and allowances can be reviewed to provide potential reductions to your business taxes.

This ensures all corporation tax issues are complied with, including:

- Preparation of corporate tax computations.

- Completion and submission of corporation tax returns.

- Assistance with HM Revenue and Customs enquiries.

Site Navigation

Connect With Us

If you are on the lookout for some help with your corporation tax, then there is plenty out there to help you. Getting your corporation tax right is an essential thing to do, not least for the fact that you can land yourself in a lot of trouble if you fail to do it right. That’s why most companies use accountants to help set it all straight. Here are some of the common queries and concerns business owners have around corporation tax, including why it might be that an accountant can help you out.

What Is Corporation Tax?

Simply put, corporation tax is a tax that all businesses must pay on their profits. If you are doing business as a limited company, a foreign company with a UK branch or office, or a club, then you need to pay corporation tax on profits by law. You have to register for corporation tax and report what you owe - you won’t simply get a bill for it.

What Is A Corporation Tax Return?

To tell HMRC how much corporation tax you owe, you need to send off a corporation tax return every year. Your company must file such a return if you receive a notice to deliver a company tax return from HMRC, and you have to send it even if you make a loss or you don’t have any corporation tax that needs paying.

Filing A Corporation Tax Return

When it comes to filing your corporation tax return, this is one of those things where having an accountant can really help. It is one of the most common corporation tax services that you can be offered, and you should consider making use of it. You can usually do it online, but if you use an accountant they can do it all for you.

Corporation Tax Deadline

It’s always important to know when the deadlines are for this kind of thing, as it is going to make a huge difference to how you approach your fiscal year. There are a couple of deadlines you need to be aware of specifically. Firstly, there is the deadline for the tax return, which is 12 months after the end of your accounting period. Then there is the deadline for paying any tax owed, which is normally 9 months and a day after the end of that same period.

Corporate Tax Rates & Breaks

The corporation tax rate is currently 19%. There are different reliefs you might be able to claim, such as R&D reliefs, and your accountant can help to determine which of these you might be eligible for.

The Importance Of Accounts Filed On Time And Correctly

If you fail to file accounts on time, you will receive penalties, and likewise if you fail to pay the tax on time. It is also against the law to knowingly enter incorrect information on your accounts. With an accountant, you can avoid those kinds of mistakes, ensuring that you avoid getting in trouble and therefore keeping your money intact.

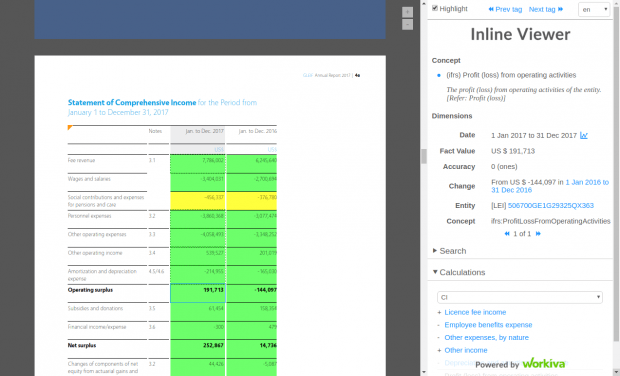

iXBRL Filing

From April 2011, all Corporation Tax returns and accounts must be filed with HMRC in iXBRL format. This has created a substantial administrative burden on companies and we already have experience in dealing with this matter on behalf of our clients. Even if a company's routine tax affairs appear simple, there are times during a company's lifecycle when specialist advice is vital, if opportunities to save tax are to be maximised.

GGM Accountancy Ltd advises companies, their owners and professional advisers on the best ways of dealing with tax efficiently on these occasions. Our solutions are practical, legally compliant and promote business growth.

In addition to corporate tax solutions, we also provide VAT planning and related services as well. Contact our staff and get started with an appointment today.

If you need to streamline your business accounts, get in touch with GGM Accountancy today.

Corporation Tax Frequently Asked Questions

- What is Corporation Tax?

Corporation tax, also known as corporate tax is a direct tax which is imposed by a jurisdiction on the capital of businesses in the UK. It's calculated on their annual profits. It is a legal necessity for a company to submit their company tax return (form CT600) to HMRC once a year.

- What is a Corporation Tax Return?

A company tax return is necessary financial information that most companies file with HMRC each year to report on their earnings, losses, loans and any other financial factors which is relevant to their tax liability.

Companies will use this information to help calculate the Corporation Tax that they owe to HMRC each year.

- When is Corporation Tax Due?

You must pay your corporation tax 9 months and one day after your yearly accounting period has ended. An accounting period is usually your financial year.

- How is Corporation Tax Calculated?

Corporation tax is the tax that UK companies pay on their taxable profits. The current corporation tax is 19%. However, this is due to change as of 1st April 2023 from 19% to 25% if your net profit is over £250,000.

What our customers say about us

Proud Members Of

Menu

Get In Touch

Tel: 01733 247500

Email: admin@ggmaccountancy.co.uk

Office: Unit 12, Broadway Shopping Centre

Malting Square, Yaxley, Peterborough

PE7 3JJ

Sign Up To Our Newsletter

Contact Us

We will get back to you as soon as possible

Please try again later

Proud Partners Of

Menu

Get In Touch

Tel: 01733 247500

Email: admin@ggmaccountancy.co.uk

Office: 42 Tyndall Court, Commerce Road

Lynch Wood, Peterborough, PE2 6LR

Follow Us On Social Media

Sign Up To Our Newsletter

Contact Us

We will get back to you as soon as possible

Please try again later

All Rights Reserved | GGM Accountancy Ltd | Website designed by Onelink Media