GGM Newsletters

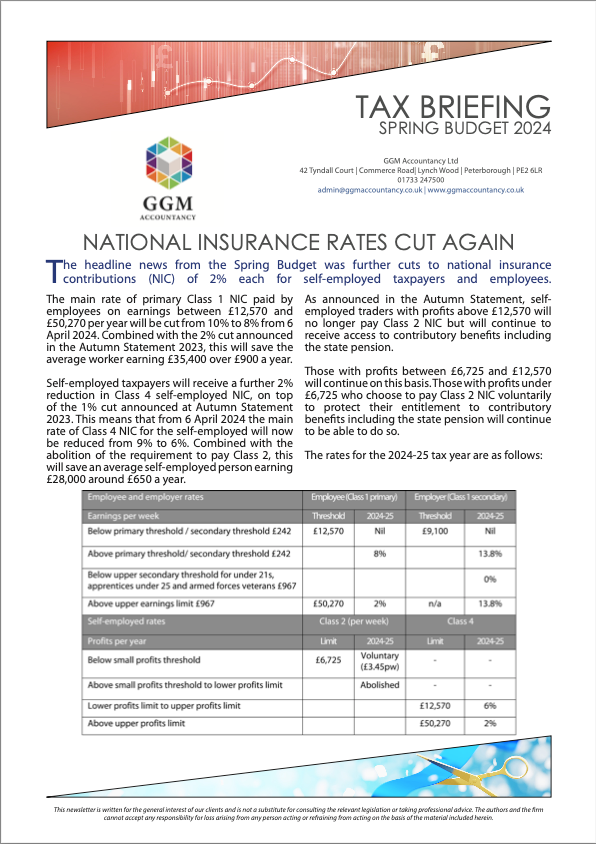

Spring Budget 2024 | Tax Briefing

SPRING BUDGET 2024

A round up of the Spring Budget 2024, following the Chancellor's update.

Not so trivial tax-exempt benefits 2023/24 | February 2024

TAX FREE PERKS

Providing non-cash benefit to your employees can promote a feeling of goodwill, particularly where they can be provided without triggering a tax or National Insurance liability.

The trivial benefits exemption is handy if you want to provide low-cost benefits to your employees. However, there are traps that you need to avoid.

Download our newsletter for the latest trivial benefit news.

2023-24 | Year End Tax Review

GGM YEAR END TAX REVIEW

Our Year End Tax Review for 2023-24.

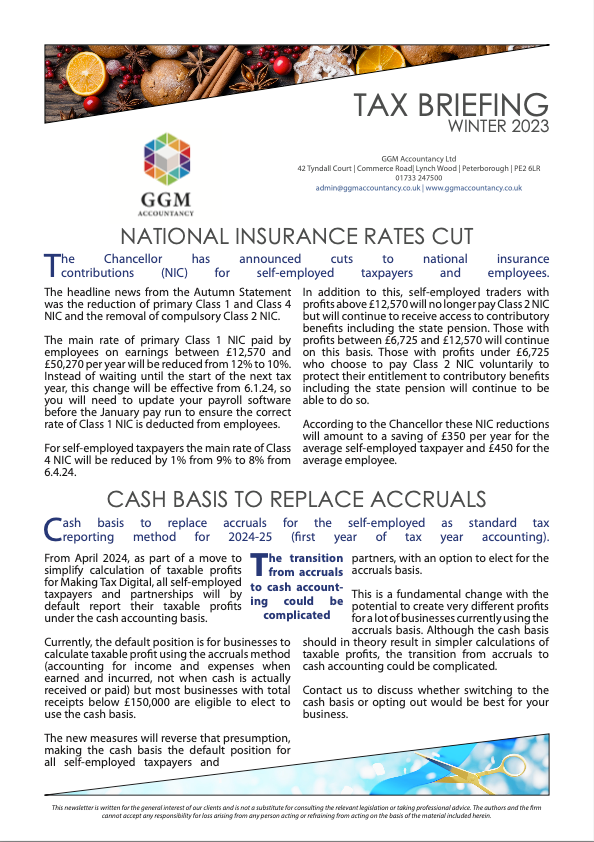

Tax Briefing | Winter 2023

NATIONAL INSURANCE RATES CUT

The Chancellor has announced cuts to national insurance contributions (NIC) for self emplyed taxpayers and employees.

The headline news from the Autumn Statement was the reduction of primary Class 1 and Class 4 NIC and the removal of compulsory Class 2 NIC.

Download our

Winter Tax Briefing for the latest tax news.

The Autumn Budget | Autumn 2023

A GUIDE TO THE AUTUMN STATEMENT 2023

The Chancellor delivered his Autumn Statement for Growth aimed at building a stronger and more resilient economy. He highlighted that the plan is to “unlock growth and productivity by boosting business investment by £20 billion a year, getting more people into work, and cutting tax for 29 million workers”.

Key measures announced by the Chancellor in the Autumn Statement are summarised within this Guide.

Tax Breaks: Working from home | October 2023

BUSINESS & PERSONAL TAX 2023-24

If you are choosing, or required to work from home, you may be able to benefit from a number of tax breaks.

The nature of the available tax breaks varies depending on whether you are an employee, self-employed or operate your own limited company.

Separate considerations also arise if you have a home office.

Tax Briefing | Autumn 2023

PENSIONS UPDATE - INCOME TAX FOR BENEFICIARIES

In the Spring budget 2023, the Chancellor announced a welcome change to the tax treatment of pensions - the scrapping of the Lifetime Allowance (LTA).

The LTA stood at £1,073,100 when the process began on 5 April 2023 with the removal of the LTA charge. This means that withdrawals can now be made from pensions in excess of the LTA without being subject to the previous rates of 55% for lump sums and 25% for regular drawdowns.

Download our Autumn Tax Briefing for the latest tax news.

Electric Vehicles: The Tax Breaks | August 2023

BUSINESS & PERSONAL TAX 2023-24

If you provide your employees with company cars or company vans, or if your employees use their own vehicles for work, you may wish to consider switching to electric vehicles to take advantage of some of the tax breaks that are on offer.

Although the tax charges for electric and low emission cars are to rise from April 2025, employers and employees who make green choices will continue to pay less tax and Class 1A National Insurance that those who do not.

Changes to Self-Employed Tax | July 2023

RULES FOR UNINCORPORATED BUSINESSES ARE BEING ABOLISHED

In preparation for the introduction of Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) the basis period rules for unincorporated businesses are being abolished.

Following the change, unincorporated businesses – basically the self-employed - will be assessed on the profits earned in the tax year rather than the profits of the account’s year ending in a tax year. The new rules take effect from 2024/25, with 2023/24 being a transitional year.

National Insurance Planning 2023-24 | June 2023

NATIONAL INSURANCE CONTRIBUTIONS 2023/24

National Insurance contributions are payable by employer, employees and the self-employed. Individuals may also pay voluntary contributions.

Different classes of contribution are payable by different types of contributor.

Tax Briefing | Summer 2023

WHAT STATE PENSION WILL YOU RECEIVE?

The amount of your state pension is largely determined by how many years of NIC you have completed during your working life. You can check your NIC record in your online personal tax account (www.gov.uk/ personal-tax-account).

Paying voluntary NIC is effectively an investment decision. Consider whether paying extra NIC now will pay back sufficiently in the form of extra state pension over your expected lifetime.

Download our Summer Tax Briefing for the latest tax news for Summer 2023.

Tax Planning 2023 | April 2023

WHY TAX PLANNING IS A WORTHWHILE INVESTMENT

Most of us would rather avoid the word “tax” and yet tax planning offers a unique opportunity to reduce the amount of tax that you pay and make a positive contribution to your efforts to outpace the current economic downturn and emerge financially more secure.

SME News | Accountancy Practice of the Year

ANOTHER WIN FOR GGM!

After winning Accountancy Practice of the Year - Cambridgeshire at the UK Finance Awards, SME News featured GGM Accountancy in their latest edition of SME News Magazine.

The full article can be downloaded here.

The Spring Budget | Spring 2023

SPRING BUDGET 15 MARCH 2023

This Summary covers the key tax changes announced in the Chancellor’s speech and includes tables of the main rates and allowances.

At the back of the Summary you will find a calendar of the tax year with important deadline dates shown.

We recommend that you review your financial plans regularly as some aspects of the Budget will not be implemented until later dates.

We will, of course, be happy to discuss with you any of the points covered in this report and help you adapt and reassess your plans in the light of any legislative changes.

Tax Briefing | Spring 2023

PLANNING DIVIDENDS IN 2023

Owners and directors of family businesses often take a small salary from the company and any extra funds as dividends.

Taxpayers who receive dividends in excess of their dividend allowance need to inform HMRC.

Owners and directors of family businesses often take a small salary from the company and any extra funds as dividends. Other family members may also hold shares in the company and receive a dividend each year.

Capital Gains Tax on UK Property | January 2023

TELL HMRC ABOUT CGT ON UK PROPERTY OR LAND

From 6 April 2020, the government brought new rules on reporting and paying the Capital Gains Tax (CGT).

Under this new regime, you must report and pay the CGT on UK residential property within 60 days after selling the property. In addition, CGT return must be filed using the HMRC digital service.

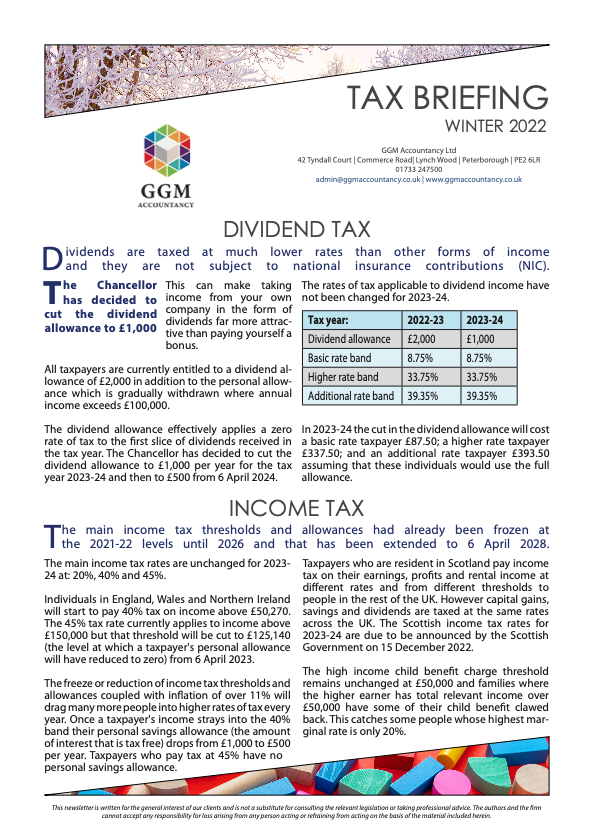

Tax Briefing | Winter 2022

HOME BUYERS PAY LESS STAMP DUTY

When buying a residential property in England or Northern Ireland you must pay stamp duty land tax (SDLT) if the purchase price exceeds a minimum threshold set at £125,000 since 2006.

In September's mini-Budget the then Chancellor announced that the entry threshold for SDLT payable on residential properties would double to £250,000 for deals completed on or after 23 September 2022. This higher threshold will apply until April 2025.

Where all the purchasers of the property have never owned a property they can take advantage of a first- time buyer minimum SDLT threshold of £425,000, increased from £300,000. If the property costs more than £625,000 (previously £500,000) the first-time buyer threshold does not apply.

The Autumn Statement | November 2022

AUTUMN STATEMENT 2022

This Summary covers the key tax changes announced in the Chancellor’s speech and includes tables of the main rates and allowances.

At the back of the Summary you will find a calendar of the tax year with important deadline dates shown.

We recommend that you review your financial plans regularly as some aspects of the Budget will not be implemented until later dates.

We will, of course, be happy to discuss with you any of the points covered in this report and help you adapt and reassess your plans in the light of any legislative changes.

Entertaining Vs Subsistence | October 2022

HOW TO TELL THE DIFFERENCE BETWEEN ENTERTAINING AND SUBSISTENCE.

As Christmas parties and team celebrations are looming, it can be hard to figure out what is legitimately subsistence and what is entertaining, but it’s important to know as HMRC treats the two very differently.

Tax Briefing | Autumn 2022

COST OF TRAVELLING TO WORK

Travelling to the workplace may now be unaffordable for some employees, but employers who help by reimbursing travel expenses could be creating an extra tax burden for themselves and their employees.

We can help you ensure that any assistance given to your employees meets the tax legislation requirements.

Emergency Budget | September 2022 - updated

DAWN OF A NEW ERA?

In his first Budget speech as Chancellor, Kwasi Kwarteng said that ‘we need a new approach for a new era, focused on growth’. He would build this around three priorities: reforming the supply side of the economy, maintaining a responsible approach to public finances, and cutting taxes to boost growth. What followed certainly delivered on the third of these: this package has been described as the biggest tax cutting budget for half a century, following on from the earlier announcement of very substantial support for individuals and businesses coping with rising energy prices.

Unincorporated Landlords | August 2022

TAX RELIEF FOR PROPERTY REPAIRS AND IMPROVEMENTS 2022/23

The fact that repairs are carried out at the same time as improvement works does not make repair expenditure capital expenditure; it remains deductible as revenue expenditure. However, good records and itemised bills and quotes should be kept so that repairs can be correctly identified.

HMRC also accept the replacement of a kitchen or bathroom with a modern equivalent is a repair rather than an improvement.

Building a Pension Pot | July 2022

MAKING THE MOST OF YOUR PENSION CONTRIBUTIONS 2022/23

Review your pension provisions and plan your pension contributions for the 2022/23 tax year.

Tax Briefing | Summer 2022

CHANGING NIC IN JULY

The rates for national insurance contributions (NIC) increased by 1.25 percentage points for everyone on 6 April 2022. From 6 July the NIC starting threshold will rise to £12,570 per year (£1,048 per month) for employees.

This means that some lower paid employees will have more Class 1 NIC deducted from their pay from April to June 2022 but may pay no NIC from July 2022 onwards.

When to incorporate your Business | May 2022

WHEN TO INCORPORATE 2022/23

If you are thinking of setting up a business, or if you already operate as a sole trader, you may be considering whether to incorporate your business, and if so, when to incorporate.

This decision will affect the way in which you run your business and ultimately, what taxes you pay, and when you pay them.

Making Tax Digital | April 2022

MTD FOR VAT IS COMPULSORY

Making Tax Digital is a key part of the government’s plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs.

HMRC’s ambition is to become one of the most digitally advanced tax administrations in the world. Making Tax Digital is making fundamental changes to the way the tax system works – transforming tax administration so that it is more effective, more efficient, and easier for taxpayers to get their tax right.

Tax Briefing | March 2022

MTD FOR VAT IS COMPULSORY

For VAT periods starting on and after 1 April 2022 all VAT records must be recorded digitally and returns must be submitted under the Making Tax Digital (MTD) regime.

If you are not already submitting your VAT returns using MTD-enabled software (or asking us to do so) you need to take action.

We can help with this...

Tax Free Childcare | February 2022

THE 20% TOP UP

HMRC is reminding parents that thousands of UK working families might be missing out on a chance to earn up to £2,000 per year in assistance for childcare expenses.

Tax-free childcare - the 20% top-up for working parents provides up to £500 every three months (or £1,000 if your child is disabled) towards holiday clubs, before and after-school programs, childminders, nurseries, and other approved childcare arrangements...

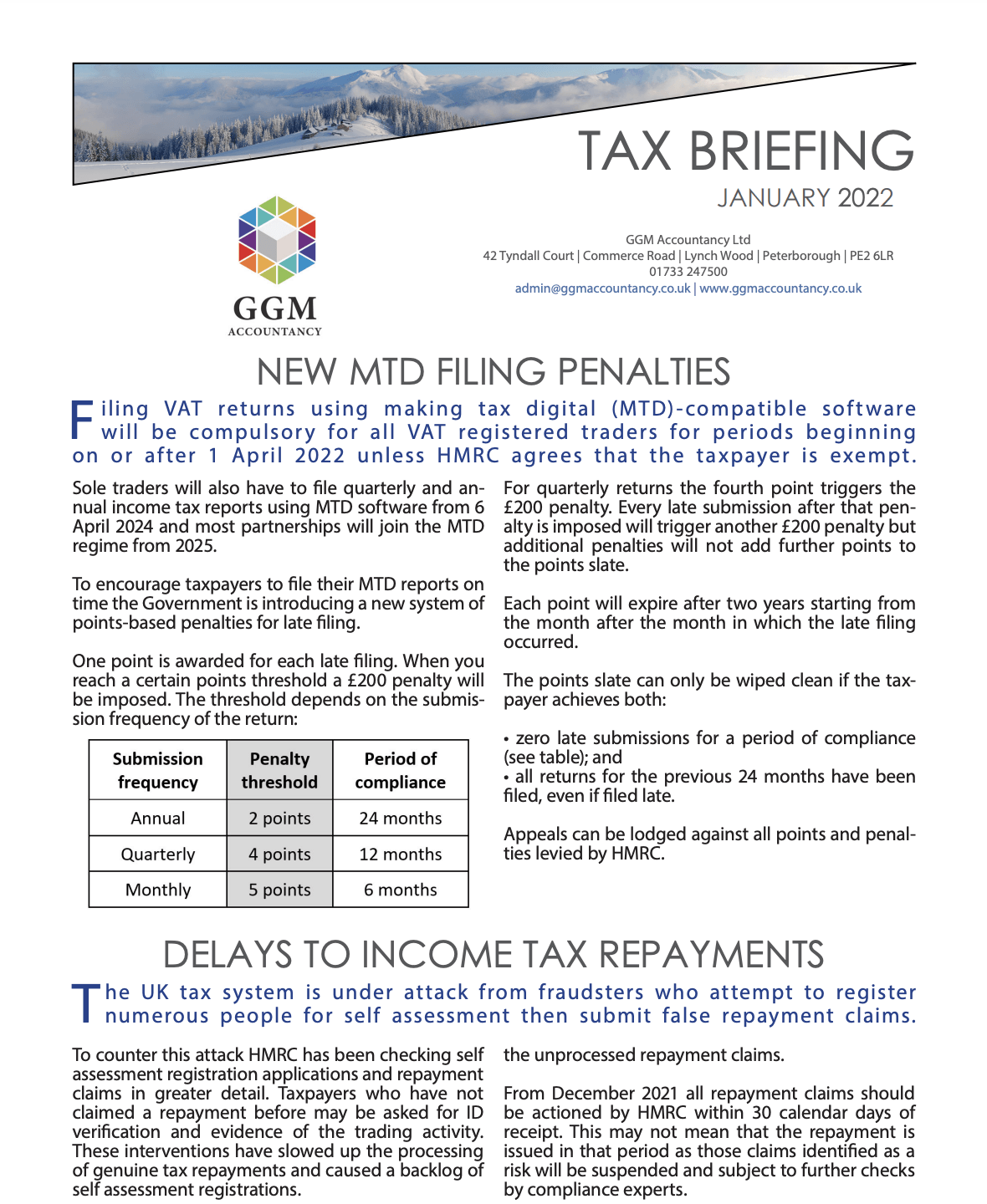

Tax Briefing | January 2022

NEW MTD FILING PENALTIES

Filing VAT returns using making tax digital (MTD)-compatible software will be compulsory for all VAT registered traders for periods beginning on or after 1 April 2022 unless HMRC agrees that the taxpayer is exempt.

Sole traders will also have to file quarterly and annual income tax reports using MTD software from 6 April 2024 and most partnerships will join the MTD regime from 2025.

To encourage taxpayers to file their MTD reports on time the Government is introducing a new system of points-based penalties for late filing.....

Christmas Newsletter | December 2021

MAKING MERRY USE OF AVAILABLE TAX BREAKS

We are approaching the end of two years COVID disruption and in need of distraction. This update takes you through the tax allowances and reliefs that will help you celebrate with your business colleagues, family and friends this Christmas and New Year holiday period and claim any costs as a tax-allowable deduction.

Christmas is usually a time for people to get together, and an opportunity for you to celebrate with your team. That's been difficult in recent years, but this year, perhaps can be a bit better. So, instead of the usual Christmas party, why not do something a bit different?....

Creating Multiple Income Streams | November 2021

Business Support Options

In this month's newsletter we have suggested a number of ideas for creating additional income streams. After all, in challenging times it pays to avoid having all your eggs in one basket.

The major source of new income for businesses that sell to consumers is utilising the internet. We have set out a few ideas to consider on this topic below.

What have we learned since March 2020? Primarily, that we can take nothing for granted. Customers may have been denied access to your business during periods of lockdown and teams fragmented, obliged to work from home or furloughed. The suggestion in this discussion paper is that we should no longer rely on one source of income to pay our bills. Instead, we should seek out and consider building multiple income streams....

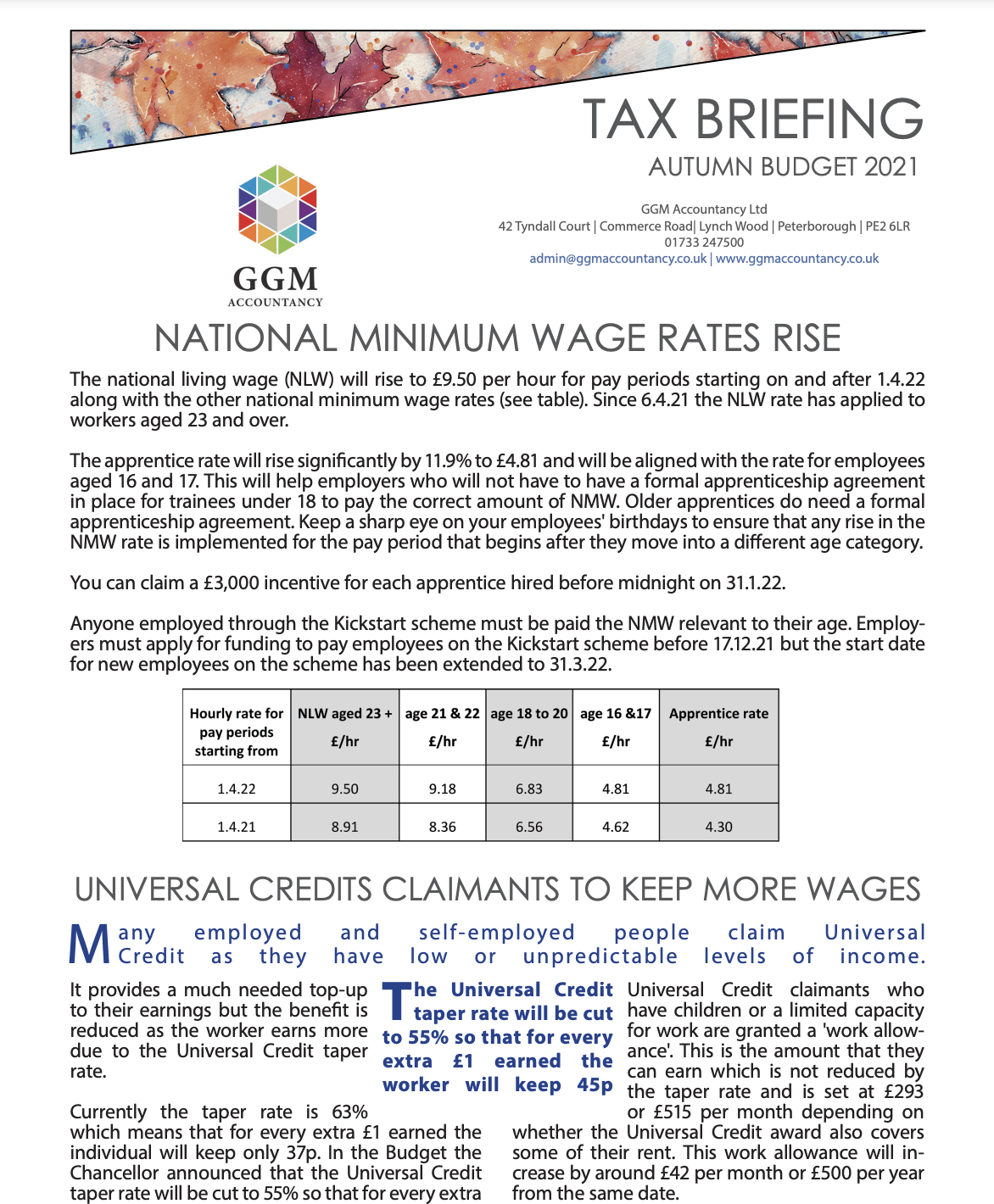

Tax Briefing | The Autumn Budget

NATIONAL MINIMUM WAGE RATES RISE

The national living wage (NLW) will rise to £9.50 per hour for pay periods starting on and after 1.4.22

along with the other national minimum wage rates (see table). Since 6.4.21 the NLW rate has applied to workers aged 23 and over.

The apprentice rate will rise significantly by 11.9% to £4.81 and will be aligned with the rate for employees aged 16 and 17. This will help employers who will not have to have a formal apprenticeship agreement in place for trainees under 18 to pay the correct amount of . Older apprentices do need a formal apprenticeship agreement. Keep a sharp eye on your employees' birthdays to ensure that any rise in the NMW rate is implemented for the pay period that begins after they move into a different age category. You can claim a £3,000 incentive for each apprentice hired before midnight on 31.1.22......

Electric Vehicles | October 2021

Understanding The Tax Advantages Of Electric Vehicles.

Now that Covid restrictions have been lifted and life is returning to ‘normality’ again, you might be considering whether to switch to an electric car, or maybe you fancy commuting on an e-bike? There are a wide range of tax benefits available now for zero or low-emission vehicles (with 2 and 4 wheels) and this newsletter explains what’s on offer if you choose to finance the investment through your company.

Calculating ‘benefit in kind’ for electric cars Firstly, the taxable ‘benefit in kind’ of a company car is determined by the vehicle’s CO2 emissions. For the 2019- 20 tax year, low emission cars (classed as up to 50g/km) were taxed at 16% of the list price, or 20% for diesel cars....

Trivial Benefits | September 2021

Providing non-cash benefit to your employees can promote a feeling of goodwill, particularly where they can be provided without triggering a tax or National Insurance liability. The trivial benefits exemption is a handy exemption if you want to provide low cost benefits to your employees. However, there are traps that you need to avoid.

Nature of the exemption

The exemption allows you to provide trivial benefits to employees without your employee suffering a tax charge on the benefit. Likewise, there is no Class 1A National Insurance for you to pay.....

Tax Briefing - MTD- September 2021

GOING DIGITAL IN ADVANCE OF MTD.

From 6 April 2023 all unincorporated businesses will have to keep their business records in a digital format and submit quarterly reports derived from those records to HMRC using MTD-compatible software. We can advise you on the different forms of accounting software that can help your business get ready for MTD.

These are the basic obligations under making tax digital for income tax self assessment (MTD ITSA). The start date of MTD ITSA is less than two years away so it is a good idea to start preparing now. However this digitisation is not as daunting as you may think...

Incorporating A Property Business | August 2021

If you have a property rental business, you may be running it through a limited company, or you may be running an unincorporated business and wondering whether you should incorporate. There are advantages and disadvantages to incorporation.

Incorporating an existing property rental business

If you already run a property rental business and want to incorporate that business, you will incur some up-front costs, which may be significant. One of the main disadvantages is that SDLT (or LBTT in Scotland or LTT in Wales) has to be paid again. As the properties are being transferred to a connected company, the SDLT is based on the market value of the property.....

Working From Home - Tax Breaks 2021 - 2022

Due to the Covid-19 pandemic, more workers than ever before are working from home.

If you work from home, you may be able to benefit from a number of tax breaks. The nature of the available tax breaks varies depending on whether you are an employee, self-employed or operate your own limited company. Separate considerations also arise if you have a home office.

The tax breaks available to employees working from home fall into two camps:

1. tax-free benefits and expenses provided by their employer

2. deductions that they can claim for expenses that they incur because of working from home.....

Tax Briefing June 2021

Council tax (for residential properties) and business rates (for commercial premises) remain payable when a building is empty but there may be reliefs available. Some local authorities allow landlords to claim a discount on council tax for empty residential properties but this varies across the country. It is always worth asking your local council whether they offer such relief.....

The Budget 2021 March Newsletter

The Chancellor announced that taxes would have to rise, but not quite yet, as all tax rates except for VAT are frozen for 2021-22.

Large companies will then see their corporation tax rate rise from 19% to 25% from 1 April 2023. Companies making no more than £50,000 per year in profits will still pay tax at the current rate of 19%.....

Tax Newsletter March 2021

In the Chancellor’s second real Budget on 3 March 2021 he announced that he had to level with people about the state of the UK economy. Prior to Budget day there were fewer leaks than normal about possible tax changes. There were however announcements prior to Budget day of grants for High Street businesses and the hospitality sector and the widely predicted extension of the furlough scheme....

Menu

Get In Touch

Tel: 01733 247500

Email: admin@ggmaccountancy.co.uk

Office: Unit 12, Broadway Shopping Centre

Malting Square, Yaxley, Peterborough

PE7 3JJ

Sign Up To Our Newsletter

Contact Us

We will get back to you as soon as possible

Please try again later

Proud Partners Of

Menu

Get In Touch

Tel: 01733 247500

Email: admin@ggmaccountancy.co.uk

Office: 42 Tyndall Court, Commerce Road

Lynch Wood, Peterborough, PE2 6LR

Follow Us On Social Media

Sign Up To Our Newsletter

Contact Us

We will get back to you as soon as possible

Please try again later

All Rights Reserved | GGM Accountancy Ltd | Website designed by Onelink Media